Secure

Your Future

Helping Your Loved Ones With

Reliable Insurance Solutions

Steve Lapa

Steve Lapa

About me

As a devoted father of two energetic boys, I understand firsthand the importance of protecting what matters most. My journey in the insurance industry was inspired by my own experience of becoming a parent and realizing the profound responsibility we have to secure our family's future.

Working with life insurance isn't just a career choice for me – it's a calling that aligns with my personal values and life experiences. Every day, I help other parents like myself make informed decisions about their family's financial security. When I sit down with clients, I bring not only my professional expertise but also the perspective of a father who has navigated these same important decisions.

My two boys remind me daily of why this work matters. Whether they're playing sports, tackling homework, or simply sharing their dreams for the future, I'm motivated to ensure that every family I work with has the protection they need to keep their own dreams alive, no matter what life brings.

I believe in building lasting relationships with my clients, taking the time to understand their unique family dynamics and goals.

My approach is simple: I treat each family's financial future with the same care and attention I give to planning for my own children's security.

We got you covered!

Indexed Universal Life

This type of permanent policy not only provides a death benefit but also allows the insured to build cash value over time. It can be tailored to supplement your retirement plan.

Final Expense

Final Expense insurance provides lifelong coverage with locked-in prices that will never increase. Your policy remains active for life and ensures that all funeral and other end-of-life expenses are fully covered.

Fixed Indexed Annuities

This is a secure strategy that allows you to benefit from market gains while protecting against potential losses, ensuring your retirement remains safe.

Mortgage Protection

Mortgage protection insurance safeguards one of your most valuable assets—your home—in the event of your passing. Many policies are designed to offer a full return of premiums if you outlive the term. In the event of death, the insurance ensures that the mortgage is paid in full, allowing your family to keep the house.

Affordable Health Insurance

Whether you're an individual, a family, or a small business owner, we've got you covered. With access to over 20 A-rated carriers nationwide, including PPO, HMO, and supplemental networks, you can choose the coverage that fits your needs. Pay only for what you use!

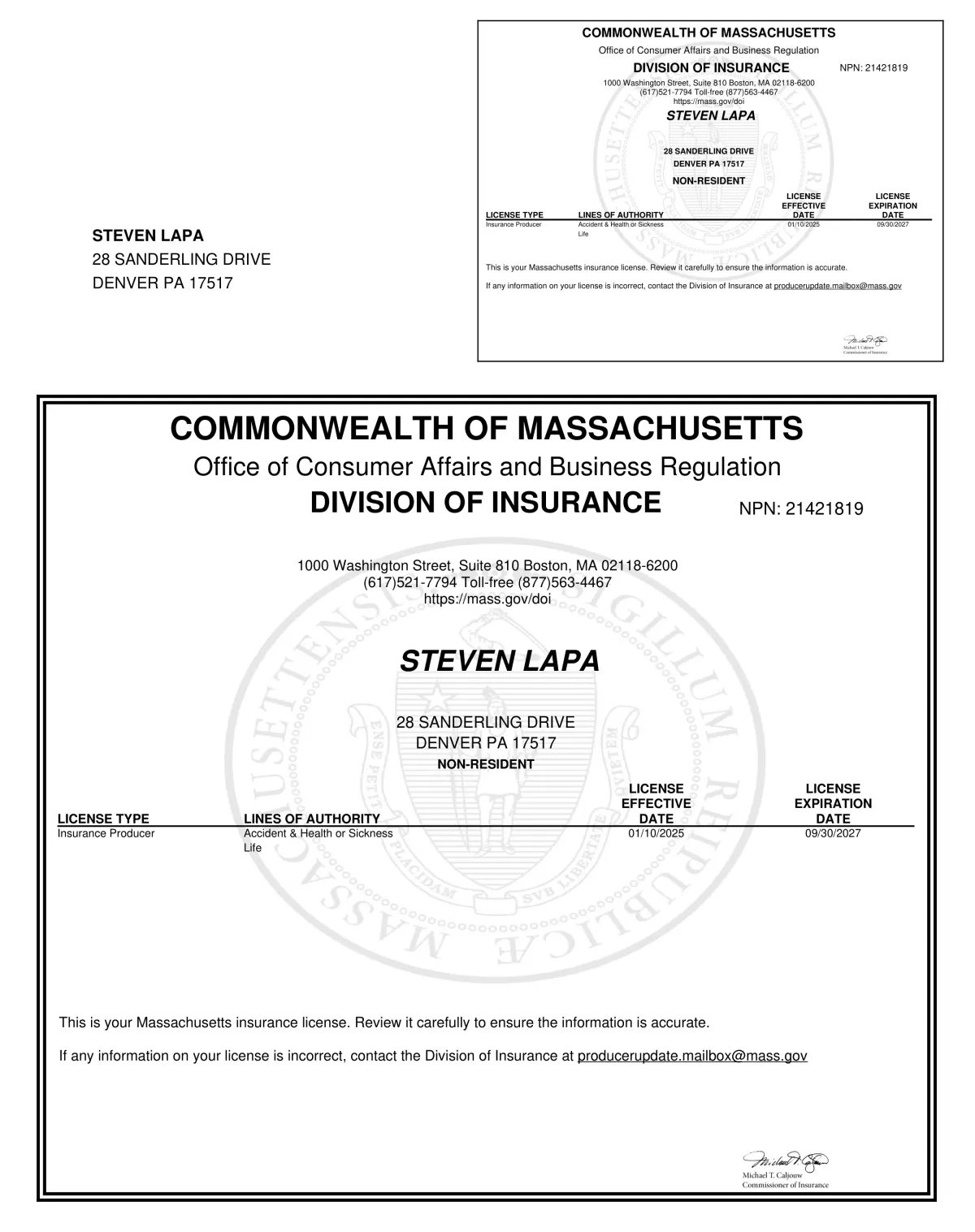

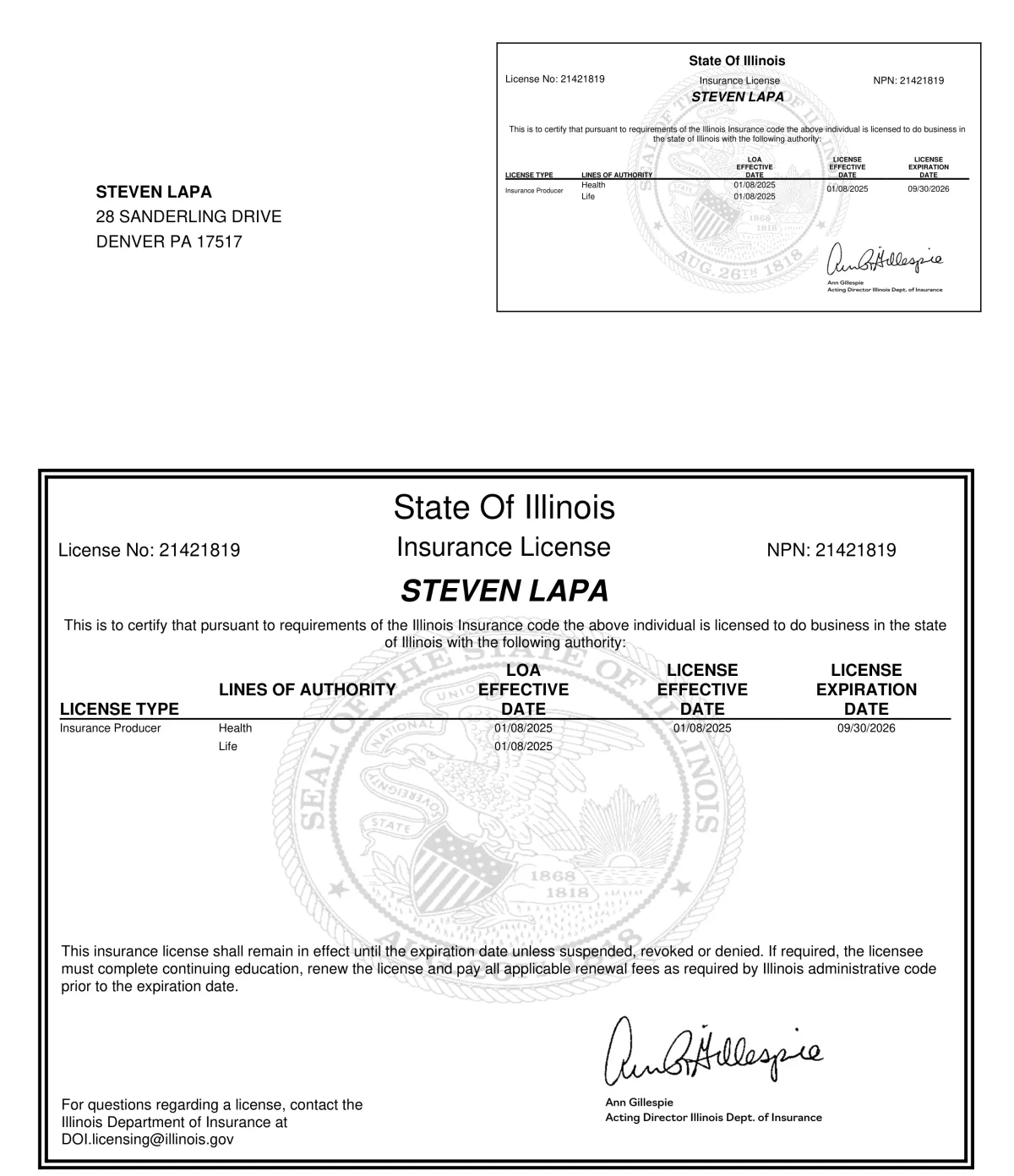

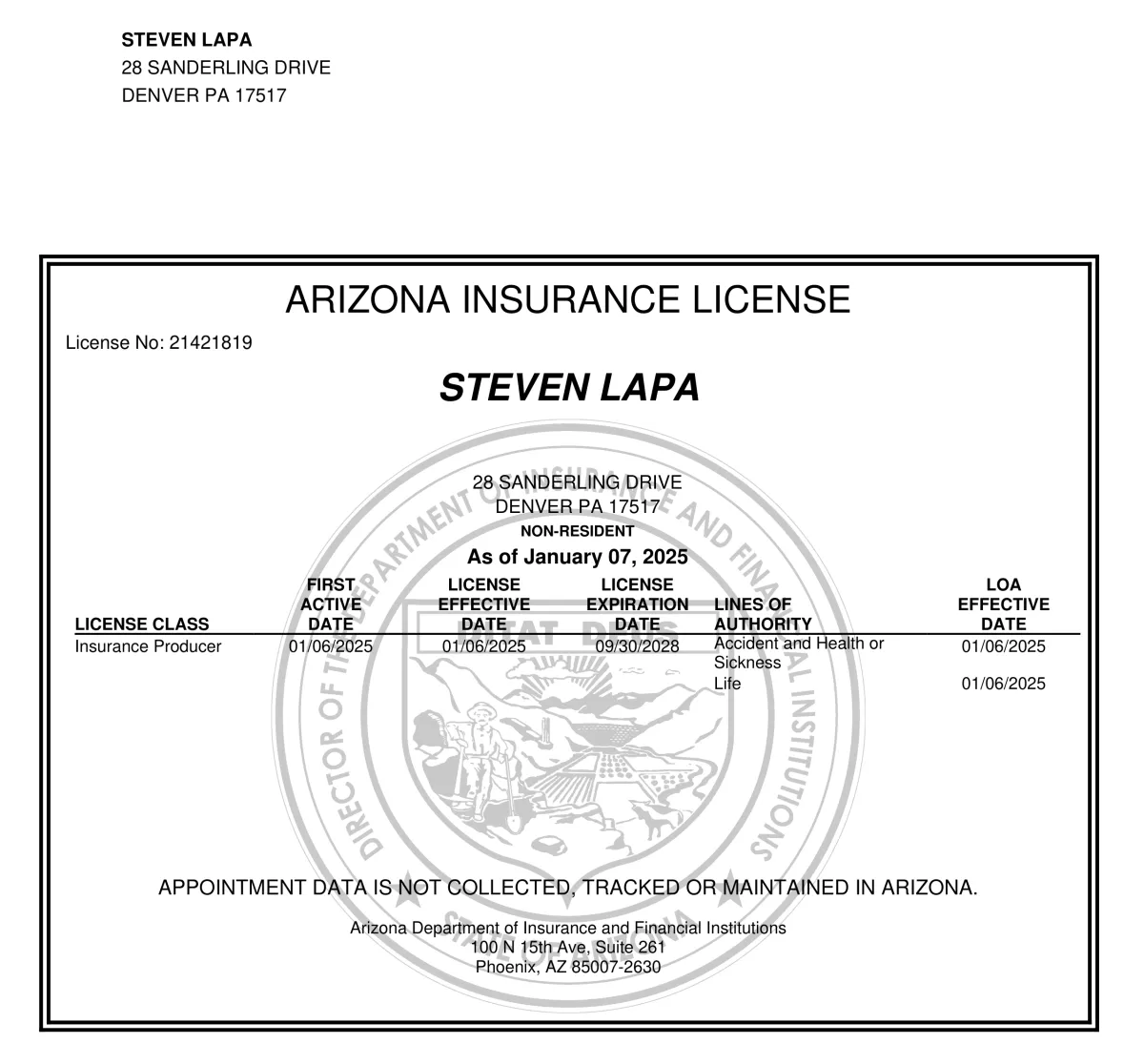

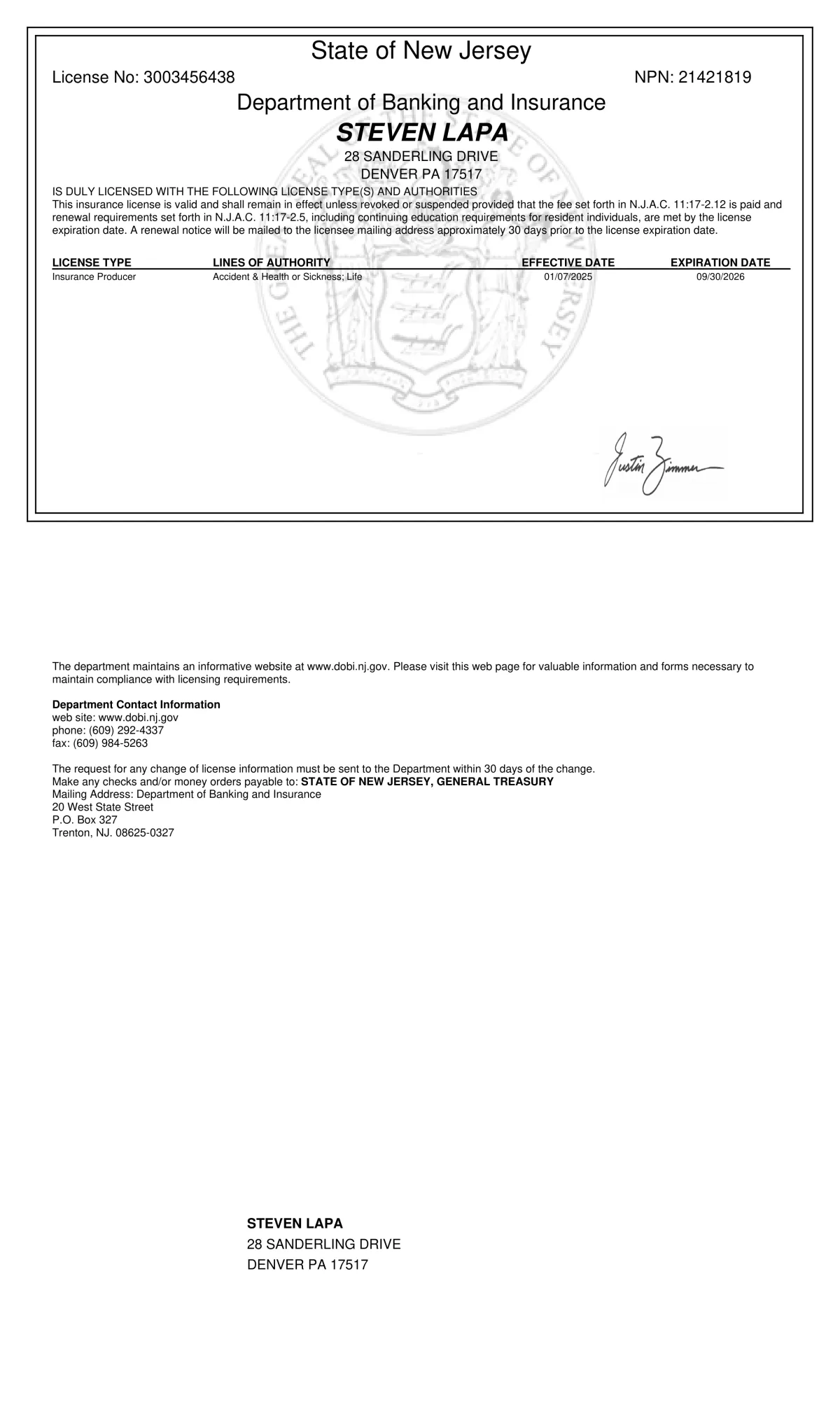

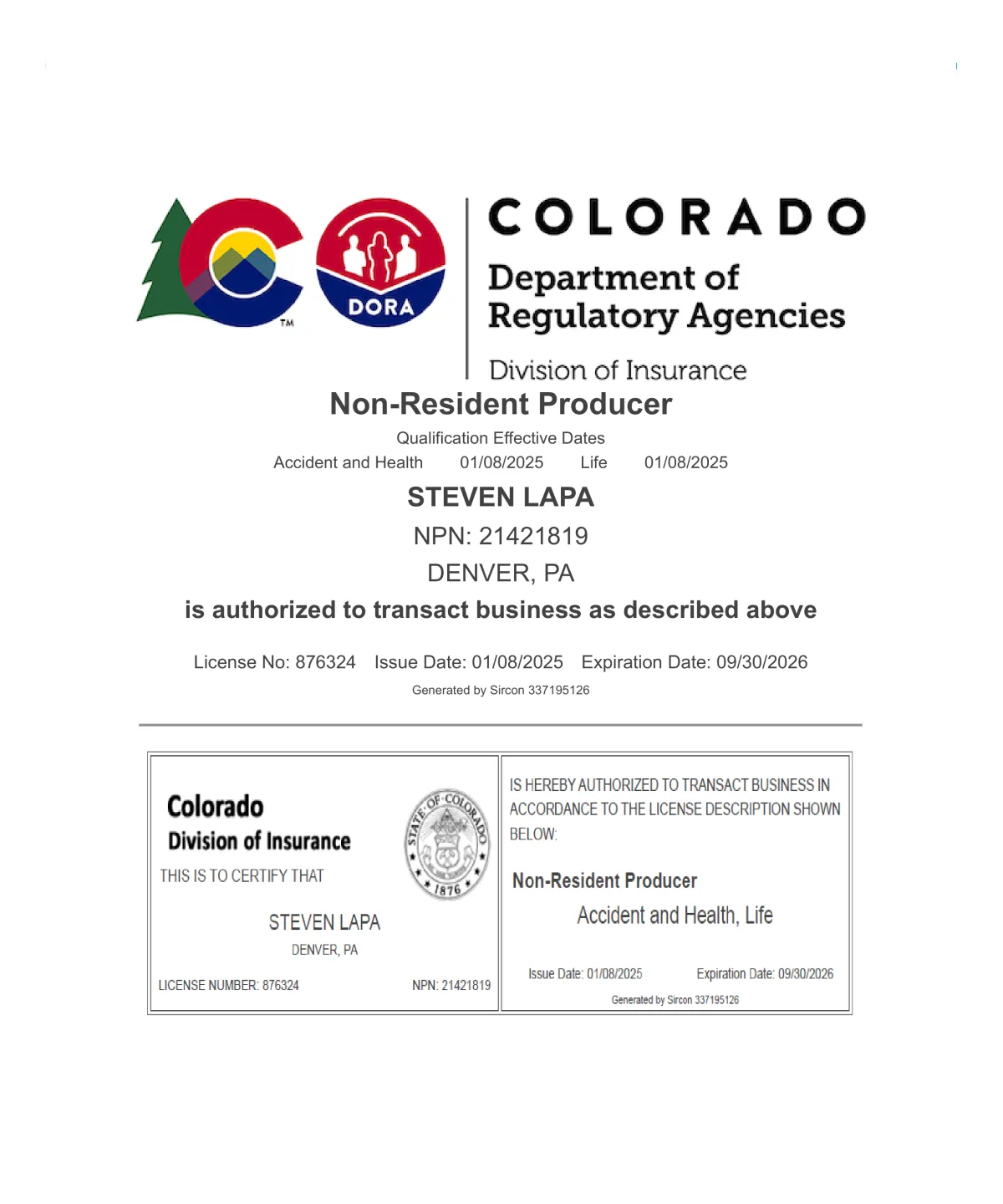

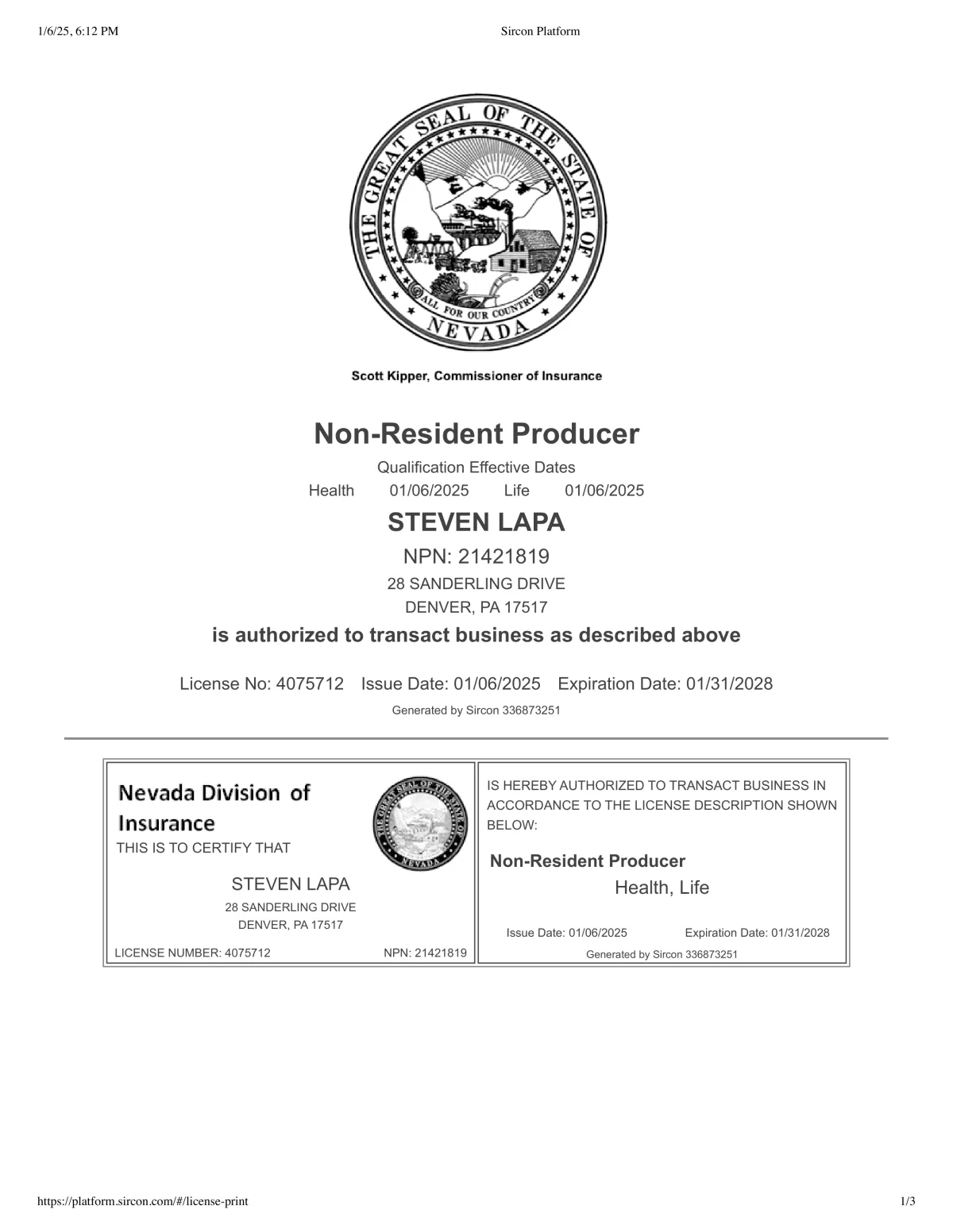

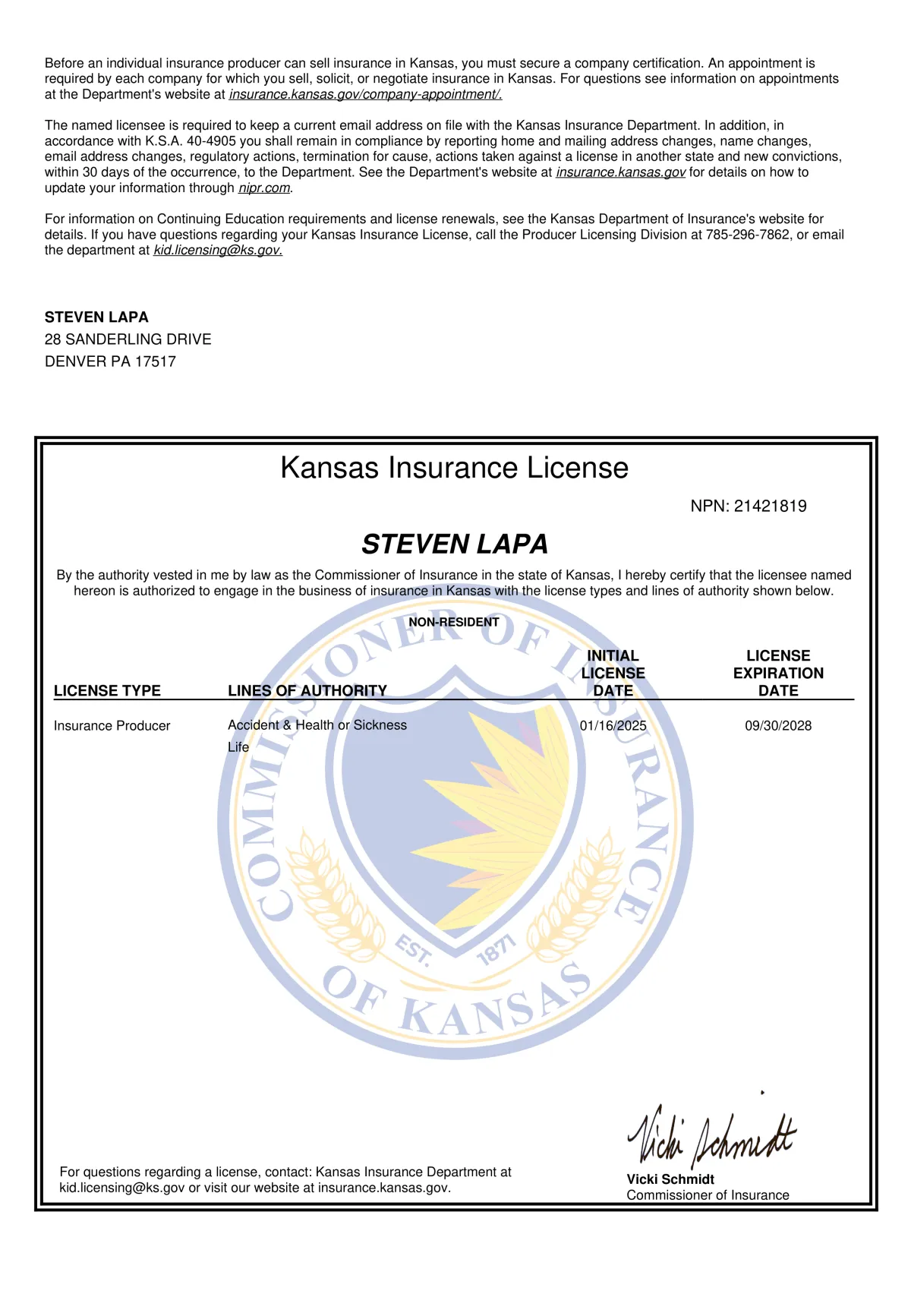

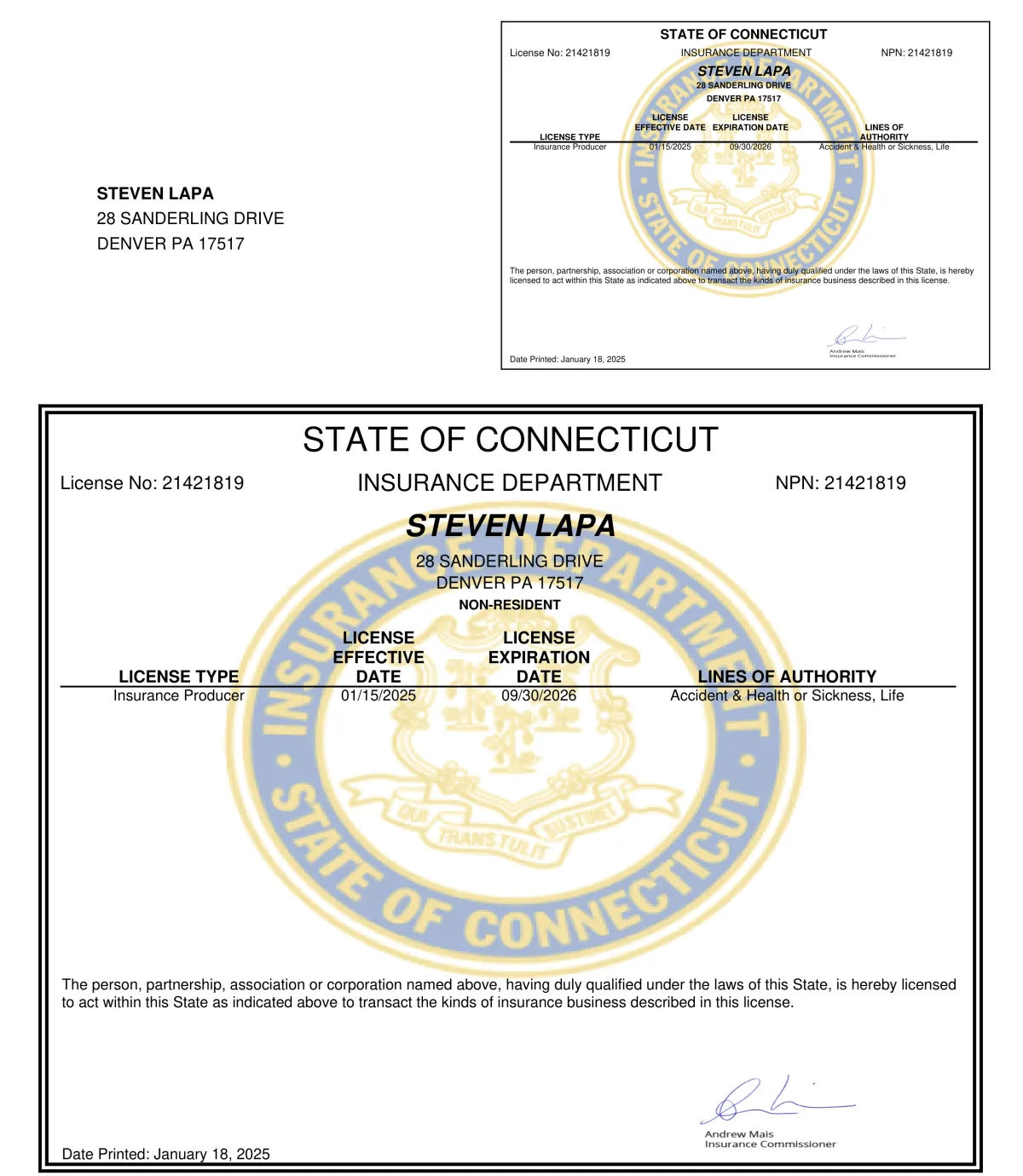

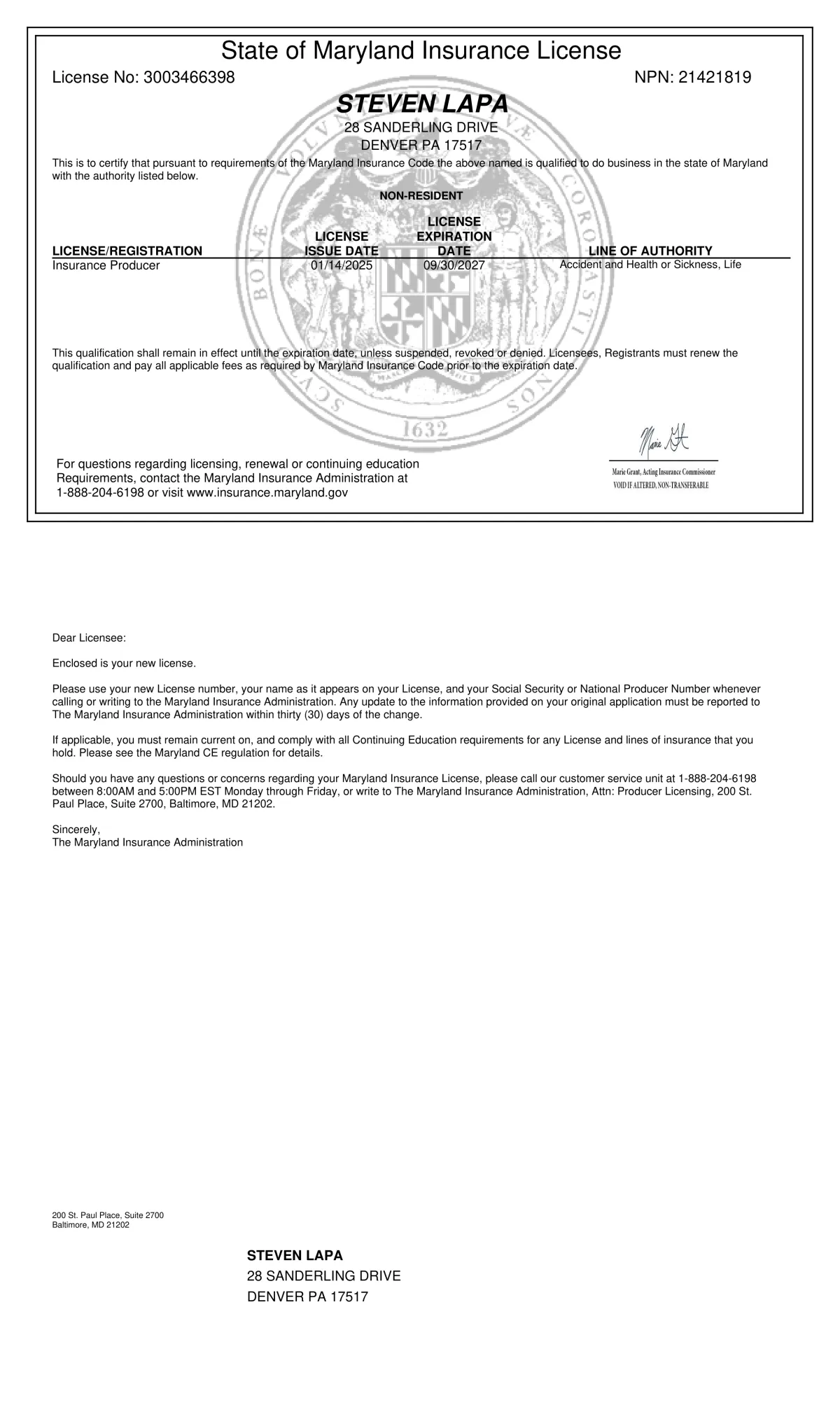

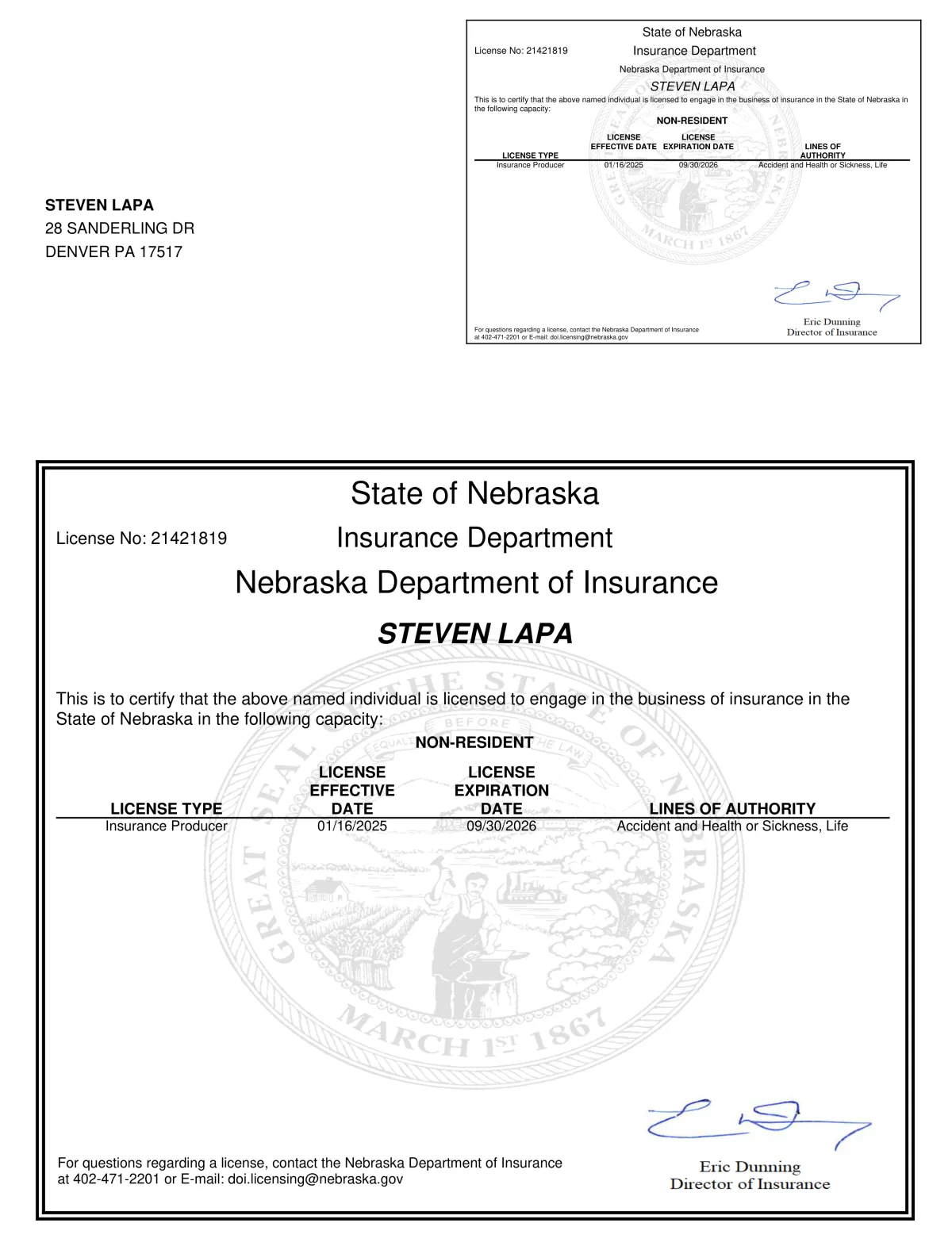

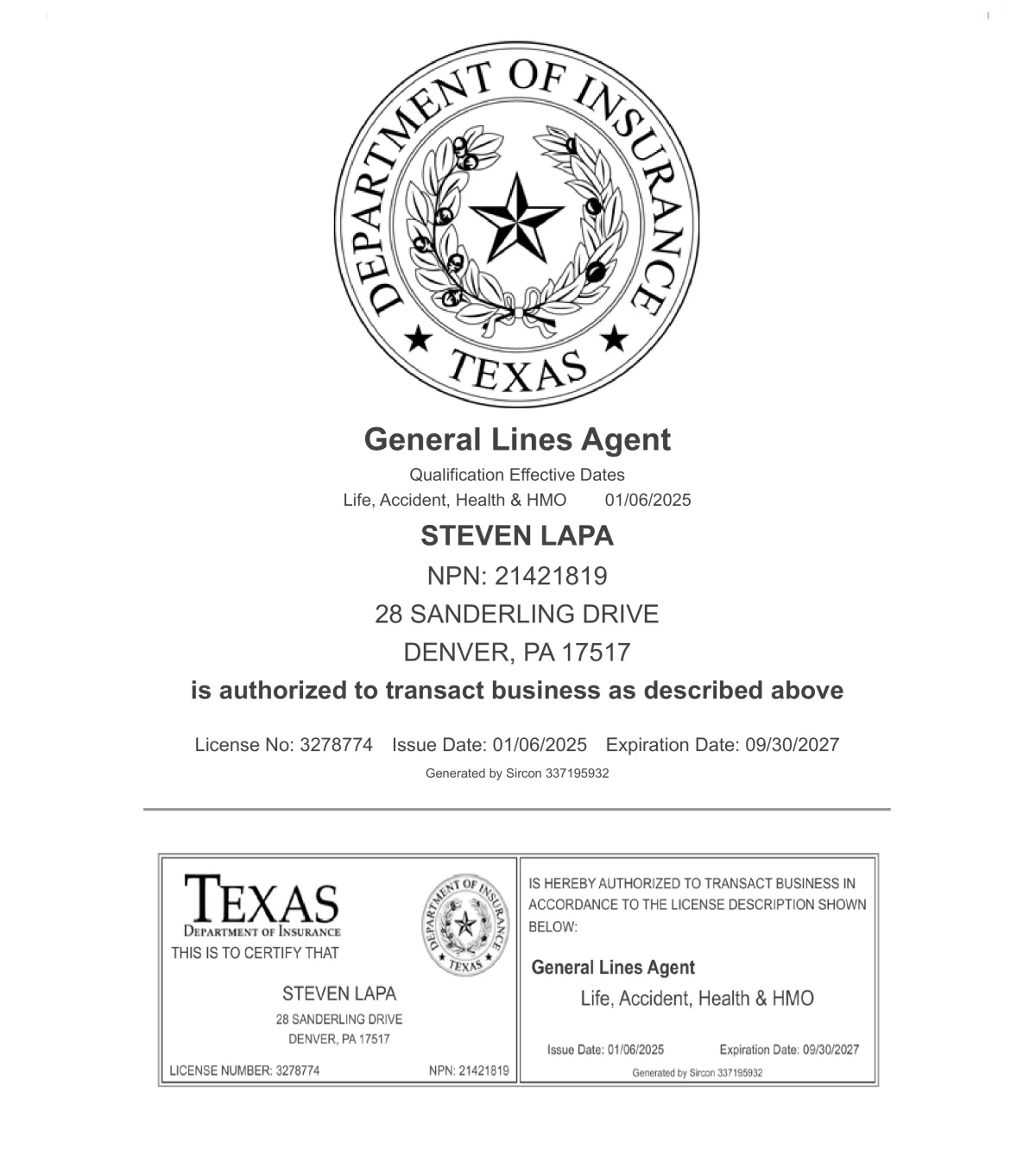

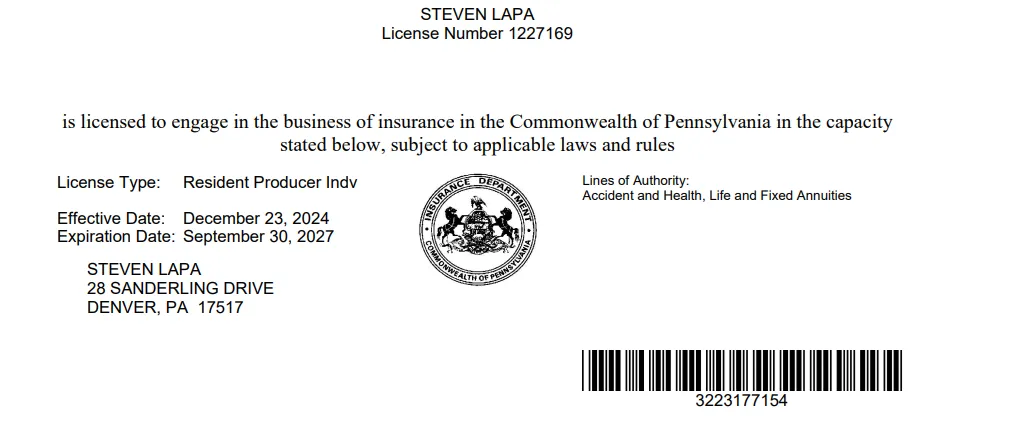

Licenses & Credentials

Industry's Best Insurance Providers

Request a Quote

Just fill out the form with your contact information and we’ll get back to you as soon as possible.

Frequently Asked Questions

Common Questions Answered for your convenience.

What types of events do you specialize in?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Do you offer customizable event packages?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

What is your approach to managing vendors and

suppliers?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How involved can I be in the event planning process?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Can you assist with venue selection and contract

negotiations?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How do you ensure event coordination and smooth

execution on the day?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.